20 Best & Effective ChatGPT Prompts for Payroll Managers

In today's fast-paced business world, efficiency is key. Payroll managers, in particular, juggle a myriad of tasks, from calculating salaries and taxes to handling employee inquiries. These responsibilities are demanding, leaving little room for error or inefficiency.

Enter ChatGPT—a powerful tool that can transform how payroll managers work. With the right prompts, payroll managers can streamline processes, improve communication, and save significant time.

This guide will provides 20 best chatgpt prompts for payroll manager to your unique needs.

Why Payroll Managers Should Use ChatGPT

Payroll management is a complex and high-stakes job. Here's why ChatGPT is a game-changer:

-

Save Time: ChatGPT automates repetitive tasks like report generation and employee communication, allowing managers to focus on strategic priorities.

-

Enhance Accuracy: By leveraging AI for calculations and compliance checks, payroll managers can minimize errors and reduce the risk of costly penalties.

-

Simplify Communication: ChatGPT can craft clear, professional responses to employee inquiries, maintaining trust and transparency in the workplace.

-

Stay Compliant: AI tools like ChatGPT help managers stay up-to-date with tax laws and labor regulations, ensuring all processes meet legal standards.

20 Best ChatGPT Prompts for Payroll Managers

1. Generating Monthly Payroll Reports

Prompt: “Create a summary of this month's payroll including total wages, deductions, and net payments. Break it down by department.”

With this prompt, payroll managers can quickly produce a detailed report that summarizes wages, deductions, and net payments. Breaking the data down by department ensures clarity and organization, making it easier to analyze payroll expenses at a glance.

2. Handling Payroll Inquiries

Prompt: “Draft a response to an employee asking about discrepancies in their paycheck. Include steps they should follow to resolve the issue.”

When employees raise concerns about their paychecks, this prompt enables managers to draft a professional and structured response. It provides clear instructions for resolution, fostering transparency and trust in the process.

3. Payroll Tax Calculation

Prompt: “Calculate payroll taxes for all employees, ensuring compliance with federal and state laws. Include social security and Medicare contributions.”

Tax compliance can be complex, but this prompt simplifies the process by ensuring all calculations include necessary contributions, such as social security and Medicare. It minimizes errors while maintaining adherence to legal requirements.

4. Year-End Bonus Calculation

Prompt: “Determine year-end bonuses based on performance metrics. Ensure they align with the company's budget.”

By using this prompt, managers can fairly allocate year-end bonuses based on employee performance and the company's financial situation. This ensures rewards are motivating while staying within budgetary limits.

5. Overtime Pay Calculation

Prompt: “Calculate overtime pay for employees who worked more than 40 hours this week at 1.5x their hourly rate.”

Overtime calculations become straightforward with this prompt, ensuring employees are compensated for their extra hours in compliance with labor laws.

6. Drafting Employee Payslips

Prompt: “Generate a payslip template including employee name, gross pay, deductions, and net pay.”

This prompt makes it easy to create a standardized payslip format that includes all essential details. It saves time while maintaining a professional presentation.

7. Compliance Checklists

Prompt: “List all compliance requirements for payroll processing in [your location].”

Staying compliant is vital, and this prompt helps managers create a comprehensive checklist to meet regional payroll regulations, ensuring nothing is overlooked.

Prompt: “Remind me of the quarterly payroll tax filing deadlines for [your region].”

Never miss an important filing date again. This prompt keeps managers on top of tax deadlines, avoiding late fees or penalties.

9. Salary Adjustments

Prompt: “Calculate a 5% salary increase for all employees earning below $50,000 annually.”

This is an efficient way to calculate and implement salary adjustments, ensuring changes are consistent and accurate.

10. Employee Tax Questions

Prompt: “Explain the difference between gross and net pay in simple terms for an employee.”

When employees have tax-related questions, this prompt helps managers provide clear and concise explanations that are easy to understand.

11. Benefits Enrollment

Prompt: “Create a step-by-step guide for employees enrolling in health benefits during open enrollment.”

This prompt assists in drafting a user-friendly guide, making the benefits enrollment process seamless for employees.

12. Payroll Error Resolution

Prompt: “Suggest a process for identifying and correcting payroll errors.”

Payroll errors can be costly, but this prompt provides a step-by-step approach to detect and resolve issues efficiently.

13. Expense Reimbursements

Prompt: “Draft a policy for employee expense reimbursement, including timelines and required documentation.”

A clear reimbursement policy is essential, and this prompt helps outline one that ensures consistency and fairness across the organization.

14. Budget Forecasting

Prompt: “Analyze payroll data trends from the last 6 months and forecast next quarter's payroll budget.”

Forecasting becomes more accurate with this prompt, allowing managers to plan payroll expenses based on data-driven insights.

15. PTO Balance Updates

Prompt: “Generate a report showing each employee's current PTO balance and year-to-date usage.”

Keeping track of PTO balances is simplified with this prompt, ensuring transparency and easy access for both managers and employees.

16. Payroll Audit Preparation

Prompt: “List the documents needed for a payroll audit and steps to ensure compliance.”

Preparing for audits can be stressful, but this prompt helps managers organize all necessary documents and follow best practices to remain compliant.

17. Tax Form Assistance

Prompt: “Explain how employees should fill out Form W-4 to adjust withholding.”

This prompt simplifies complex tax forms, making it easier for employees to understand and complete them accurately.

18. Minimum Wage Compliance

Prompt: “Check if our payroll complies with the updated minimum wage laws in [state/country].”

Ensuring compliance with minimum wage laws is crucial, and this prompt helps payroll managers verify adherence to the latest standards.

19. Termination Pay

Prompt: “Calculate final pay for an employee including unused PTO and severance pay.”

Handling termination payments can be sensitive, and this prompt ensures all calculations are accurate and fair.

20. Payroll System Integration

Prompt: “Suggest steps for integrating a new payroll software into our current system.”

Implementing new software becomes smoother with this prompt, guiding managers through the integration process while minimizing disruptions.

Tenorshare AI Bypass

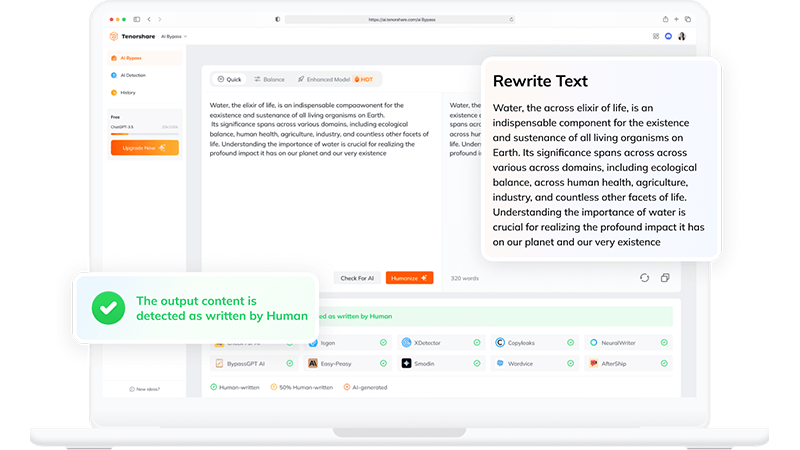

- Create 100% undetectable human-like content.

- Bypass All Al detector tool like GPTZero, ZeroGPT, Copyleaks, etc.

- Original content, free of plagiarism and grammatical errors.

- One-Click AI bypass with a clean and easy-to-use interface

5 Tips to Make Best ChatGPT Prompts for Payroll Manager

Using ChatGPT effectively requires clear and precise prompts. Follow these simple tips to get the best results:

-

Include specific details such as the legal issue, jurisdiction, or task to guide the AI effectively.

-

Always review the response to ensure it meets legal standards and is accurate.

-

Avoid sharing sensitive or confidential information, like client details or PII.

-

Use clear language and specify the tone or format needed, such as formal or simplified text.

-

Enhance your skills with certifications like Certified Prompt Engineer™ or Certified ChatGPT Expert.

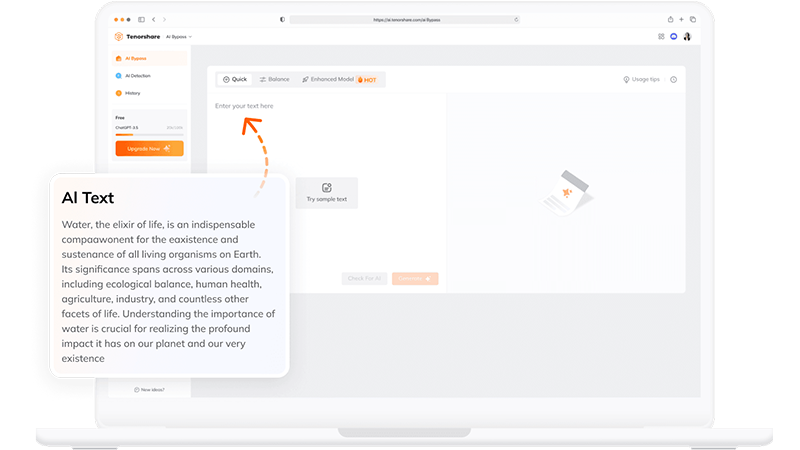

Bonus: How to Make AI-Generated Content More Human-Like

AI-powered tools like ChatGPThave revolutionized content creation. However, as AI technology advances, so do detection methods. To ensure your AI-generated content passes as human-written, Tenorshare AI Bypass is the ultimate solution.

This innovative tool effectively masks the AI signature of your text, making it indistinguishable from human-crafted work. By utilizing advanced techniques, Tenorshare AI Bypass helps you bypass AI detection tools and confidently share your content.

-

Simply copy and paste your AI-generated text into the tool's interface.

-

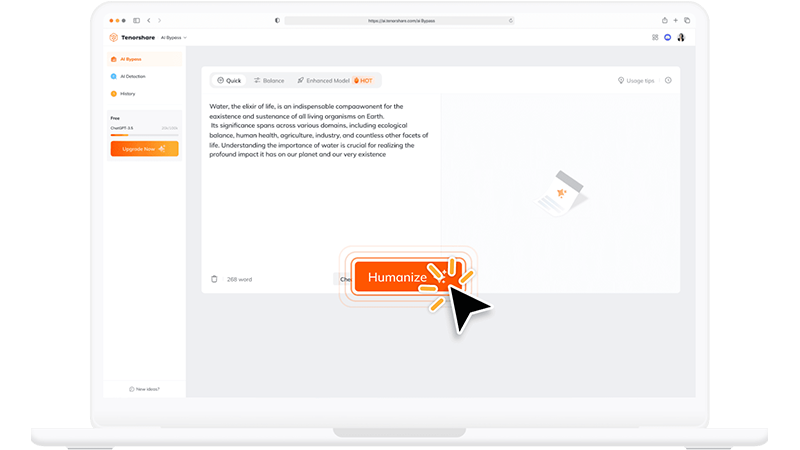

Click the "Humanize" button, and the tool will analyze your text, applying advanced techniques to rewrite and mask its AI origins.

-

Receive polished, natural-sounding text that is less likely to be flagged as AI-generated.

Conclusion

By harnessing the power of ChatGPT and following the prompts outlined in this guide, payroll managers can significantly improve their efficiency and accuracy. This AI tool empowers you to automate routine tasks, make informed decisions, and ensure compliance with complex regulations.

Remember, while ChatGPT is a valuable tool, it's essential to use it responsibly and verify the information it provides. To further enhance your workflow, Tenorshare AI Humanizer can refine AI-generated content, making it more natural, human-like, and undetectable by AI detection tools.

You Might Also Like

- 10 Best Prompts For Outlining Business Plan On ChatGPT in 2026

- 10 Useful Tips & Prompts to Make ChatGPT Write Longer

- 55+ Best Fantasy Writing Prompts for Crafting Magical Worlds and Stories

- How to Write a ChatGPT Prompt as a Social Media Manager: Benefits + Best Example Prompts

- Enhance Your Resume with ChatGPT: Essential Prompts for a Winning Job Application

- 10 Best ChatGPT Prompts for Customer Service: How to Write Effective Prompts